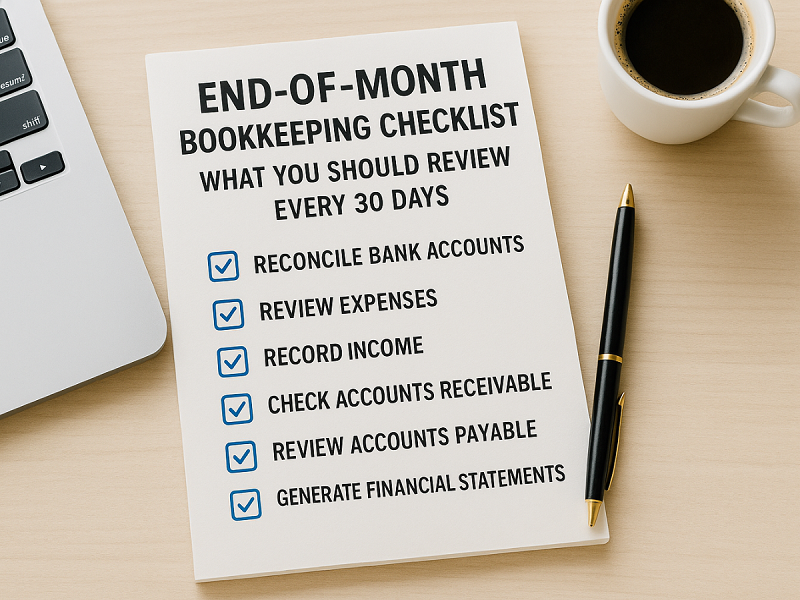

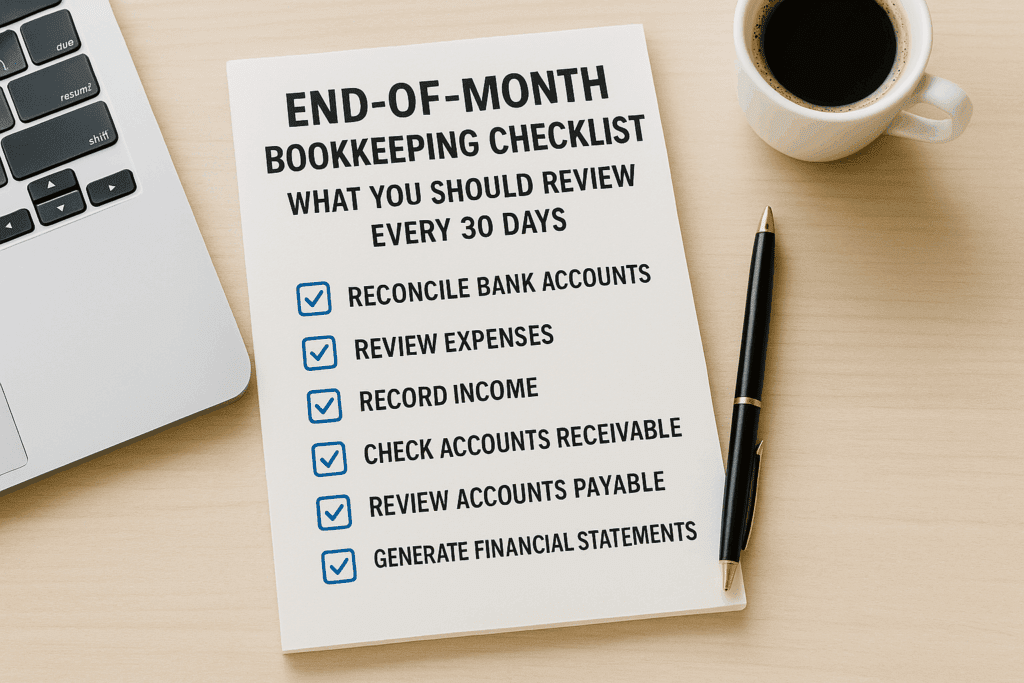

Monthly Bookkeeping Checklist for Small Businesses

Establishing a monthly bookkeeping checklist is essential for every small business that wants to stay organized and financially healthy. With a reliable monthly bookkeeping process, small business owners can keep their numbers accurate, maintain strong cash flow, and make informed decisions that help their business grow—without feeling overwhelmed.

At Bright Road Financial Services CPA, we help small businesses and entrepreneurs simplify their finances with clean, reliable bookkeeping and CPA support. If you want peace of mind at the end of every month, start with this essential checklist:

1. Reconcile Your Bank Accounts

Start your monthly bookkeeping routine by using this checklist to match your bank statements with your bookkeeping records. This ensures there are no missing transactions, errors, or duplicates. Reconciling also helps catch unauthorized charges or forgotten expenses.

Tip: Don’t forget to include credit cards and payment apps like PayPal or Stripe.

2. Record and Categorize All Expenses

Go through your receipts, invoices, and bank feeds to ensure all business expenses are recorded—and correctly categorized. Misclassified expenses can affect your taxes and financial reports.

Bonus: Digitize your receipts and store them in your bookkeeping software or cloud storage.

3. Send and Follow Up on Invoices

Unpaid invoices mean delayed cash flow. Review your accounts receivable and follow up on any overdue payments.

Pro Tip: Automate reminders or offer small discounts for early payments to encourage faster responses.

4. Pay Your Bills

Review your accounts payable to make sure you’re up to date on your bills. Late payments can hurt your credit score and strain vendor relationships.

5. Review Cash Flow

Look at how much cash came in and went out this month. Understanding your cash flow helps you prepare for slow periods, unexpected costs, and future investments.

6. Generate Key Financial Reports

At a minimum, review these three reports each month:

- Profit & Loss Statement (P&L) – Are you making or losing money?

- Balance Sheet – What are your assets, liabilities, and equity?

- Cash Flow Statement – How is money moving in and out of your business?

These reports give you insight into your business’s health and help you make smarter decisions.

7. Review Payroll and Contractor Payments

Make sure your payroll entries are accurate, tax payments are scheduled, and contractors have been paid. Staying organized helps prevent year-end tax headaches.

8. Check for Budget vs. Actual Variances

Compare what you planned to spend or earn with what actually happened. This shows you where you’re on track—and where adjustments are needed.

9. Back Up Your Financial Data

Whether you use QuickBooks, Zoho, Xero, or spreadsheets, make sure your financial data is securely backed up each month. Cloud storage is great, but having an external copy adds another layer of protection.

10. Meet With Your Bookkeeper or CPA (If You Have One)

This is your chance to ask questions, review financial trends, and plan ahead. A monthly check-in helps you catch issues early and stay financially confident.

Let Bright Road Financial Services CPA Do the Heavy Lifting

You don’t have to do it all alone. Our team of bookkeepers and CPAs is here to help you stay organized, avoid costly mistakes, and get a clear picture of your finances every single month.

Ready to simplify your bookkeeping process?

Ready to simplify your bookkeeping process? Contact us today at brightroadcpa.com or call 937-247-6001 to learn more.

Contact us today at brightroadcpa.com or call 937-247-6001 to learn more.

Save This Checklist & Make Month-End Stress-Free

A little consistency goes a long way. With the right system and support, month-end can go from overwhelming to empowering.

#BookkeepingChecklist #BrightRoadFinancial #SmallBusinessFinance #KnowYourNumbers #MonthlyReview #CashFlowMatters #EntrepreneurTips #AccountingSupport