The Top 7 Mistakes Small Business Owners Make With Their Books

— and How to Avoid Them

Managing the financial side of a small business is no small feat. Unfortunately, many entrepreneurs unknowingly make bookkeeping mistakes that can cost them time, money, and growth opportunities. Here’s a breakdown of the top 7 mistakes small business owners make with their books— and how to avoid them.

1. Mixing Personal and Business Finances

This is the most common trap. Using the same bank account or credit card for both personal and business expenses leads to confusion, poor budgeting, and major tax headaches.

Solution: Open separate business accounts and commit to keeping finances 100% separate.

2. Not Keeping Receipts or Digital Records

Small expenses add up. Without proper records, you risk losing deductions or facing an audit unprepared.

Solution: Use digital tools like QuickBooks, Expensify, or even Google Drive to organize receipts and transactions.

3. DIY Bookkeeping Without Proper Knowledge

While DIY can save money upfront, it often results in costly errors — from misclassifying expenses to incorrect tax filings.

Solution: Either invest in learning basic bookkeeping or hire a professional to review your books regularly.

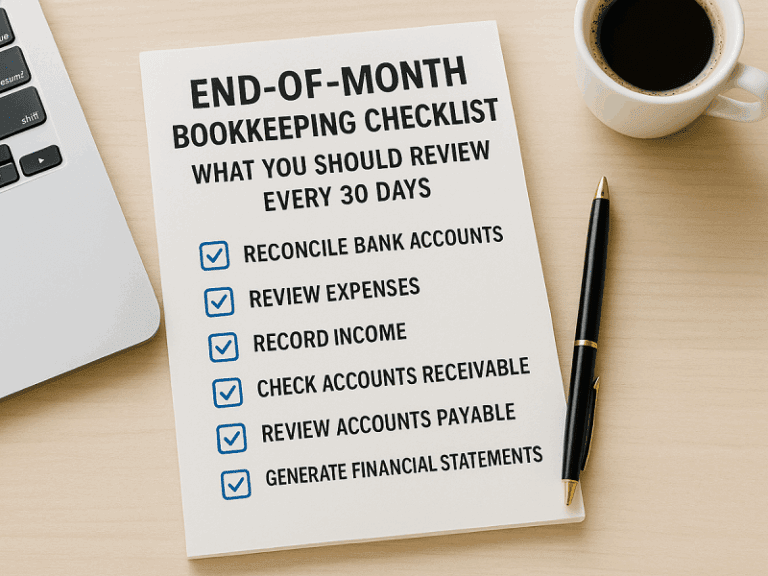

4. Falling Behind on Bookkeeping Tasks

Letting your books slide for months leads to stress, late filings, and missed financial insights.

Solution: Schedule a weekly “money hour” to reconcile accounts and review cash flow.

5. Not Reconciling Bank Statements

Failing to reconcile means you could be missing fraudulent charges, double payments, or bank errors.

Solution: Reconcile all accounts monthly — or automate it with bookkeeping software.

6. Ignoring Cash Flow Management

Focusing only on profits while ignoring cash flow can lead to serious liquidity problems.

Solution: Track inflows and outflows closely. A profitable business can still go under if it runs out of cash.

7. Skipping Professional Help During Tax Season

Many small business owners try to handle taxes alone, risking errors and missed deductions.

Solution: A tax professional can often save you more than they cost — especially when it comes to compliance and planning.

Final Thoughts

Bookkeeping might not be the most glamorous part of running a business, but it’s one of the most critical. Avoiding these common mistakes can save you stress, improve your financial health, and position your business for long-term success.

Need help with your books? Consider working with a certified bookkeeper or accountant to set a solid foundation.

Contact us today at brightroadcpa.com or call 937-247-6001 to learn more.