Nonprofit Audit Checklist: Pass the First Time

Across Dayton and the wider Miami Valley, nonprofit boards are juggling tighter budgets, more reporting requirements, and growing scrutiny from donors, funders, and the public. That’s why having a clear, board-friendly nonprofit audit checklist is more important than ever. An annual audit should help affirm your transparency—not become a source of panic, cost overruns, or last-minute chaos.

Yet according to Blackbaud’s ENGAGE blog, 1 in 3 nonprofit audits flag avoidable issues—missing grant documentation, misclassified restricted funds, or unsupported balances that could’ve been addressed with better prep.

This nonprofit audit checklist outlines a clear 30-day countdown, must-have document list, and smart ways to turn audit season into a strategic advantage. Whether you’re in Dayton, Kettering, or anywhere across the Miami Valley, this guide is built for your board.

Why Audits Fail (Hint: It’s Not Your CPA’s Fault)

We’ve seen it many times: the audit report lands, and everyone’s surprised. Not by fraud or major losses—but by things that should have been fixed months ago.

Here’s what actually causes most nonprofit audit hiccups:

• Insufficient Planning & Timeline Mapping

Without a countdown, teams scramble. Audit prep tasks pile up in the final week, leading to rushed reconciliations and missed reports. CPAs don’t fail you—unclear internal deadlines do.

• Weak Internal Controls

Auditors review processes as closely as numbers. If there’s no documented system for reviewing payroll or reconciling cash, even clean books can result in a “significant deficiency.” This erodes trust with lenders, grantors, and the board.

• Misclassified Net Assets

If donor-restricted funds are posted to unrestricted equity, or if the net asset roll-forward schedule doesn’t match the financials, expect a flagged finding. This is especially risky for grant-funded orgs with pooled checking.

• Outdated A/R Schedules

Accounts receivable over 120 days with no reserves or explanations look like overstated revenue. It’s a red flag for audit firms—and for banks, if you’re seeking financing.

These aren’t just accounting issues. They’re governance risks—and they’re all avoidable.

Nonprofit Audit Checklist: 30-Day Countdown for Dayton Boards

This timeline isn’t theory—it’s built from real audit prep work with small and midsize nonprofits across Dayton. Use it to align your team, reduce stress, and make your next audit efficient and clean.

📆 Day 30–21: Prep Starts Early

- Confirm fieldwork and audit report due dates

- Assign an internal audit liaison (ideally someone other than the Executive Director)

- Gather last year’s audit report, adjusting entries, and Management Letter

- Meet briefly with the auditor to confirm preferred file format (e.g., Excel vs PDF)

📆 Day 20–14: Reconciliations & Core Docs

- Reconcile all bank accounts, grant sub-ledgers, and credit cards

- Finalize restricted fund roll-forward (beginning + additions – releases = ending)

- Prepare detailed A/R and A/P aging reports

- Make sure grant income matches donor agreements and restriction categories

📆 Day 13–7: Build the “No-Surprise” Packet

- Create a cloud folder labeled “FYXX Audit Packet – [Org Name]”

- Save each file in auditor-preferred format with clear naming (e.g., FY24_AR_Aging.xlsx)

- Create a folder readme or checklist that lists all included files and their purpose

📆 Day 6–1: Test, Walk Through, Finalize

- Have the internal audit liaison walk through the folder with the team

- Confirm all files open correctly and reflect current data

- Send access instructions to your auditor ahead of time (login, passwords, sharing settings)

Using a countdown-based nonprofit audit checklist gives your team a clear runway—and shows your auditor you’re organized, responsive, and audit-ready.

The “No-Surprise” Document Packet

Here’s what to include in your audit folder before the first day of fieldwork:

✅ Financial Reports

- Year-end trial balance + final adjusting journal entries

- A/R and A/P aging reports with clear explanations for overdue items

✅ Grant & Donor Documentation

- All active grant agreements and donor letters with restriction details

- Roll-forward of restricted net assets, tied to fund balances

- Listing of temporarily vs permanently restricted funds, if applicable

✅ Governance & Oversight Docs

- Board minutes for the entire fiscal year

- List of board members and officers, with term dates and committee roles

- Conflict of interest forms (if part of your audit scope)

✅ Internal Controls

- Narrative descriptions of cash handling, payroll processing, and revenue recognition workflows

- Separation of duties documentation (who does what, who reviews what)

- Any updates made to policies since the prior audit year

This checklist doesn’t require a fancy accounting system—just a folder with the right docs, clearly labeled, in a format your auditor can use.

Common Trip-Wires Auditors Flag

Even if your books are clean, these technical slip-ups can still land in your Management Letter or audit findings:

- Net assets misclassified – Restricted contributions posted as unrestricted, or net assets not rolled forward correctly

- Deferred revenue errors – Grant income recorded as revenue instead of deferred, or vice versa

- Receivables > 120 days – Old pledges not reserved for, making your AR balance unreliable

- Lack of internal control documentation – Especially for organizations handling large amounts of cash or in-person donations

Each of these creates friction in the audit—and can undermine confidence with funders or board members.

Frequently Asked Questions: Nonprofit Audit Basics

What documents are needed for a nonprofit audit?

Auditors will ask for a complete trial balance, year-end financial statements, reconciled bank and credit-card accounts, A/R and A/P aging reports, grant agreements with donor restriction schedules, board meeting minutes, internal-control narratives, and key contracts or leases. Having these organized in a single “no-surprise” folder can shave days off your fieldwork timeline.

How long does a nonprofit audit take from start to finish?

Most audits take 8–12 weeks from initial planning to final delivery. Expect 4–12 weeks to select and contract your audit firm, 2–4 weeks for internal prep, and 1–3 weeks for actual fieldwork (in person or virtual). Larger organizations with complex grants or multiple entities may require more time.

Does every nonprofit need an independent audit?

Not necessarily. State requirements vary—many require audits for nonprofits with over $500,000 in annual revenue. Federally, a “Single Audit” is only triggered if you spend $750,000 or more in federal funds in a single year. However, some grantors or contracts mandate an audit regardless of size or source of revenue.

Turn Audit Findings into Better Board Reports

An audit isn’t just about compliance—it’s an opportunity to sharpen your reporting.

Here’s how to turn audit feedback into stronger governance:

- Map audit adjustments directly into your monthly financials and board KPIs

- Use Management Letter findings as a proactive risk-tracking tool for the next year

- Create a “temperature chart” that shows resolved vs open issues at each board meeting

- Add a standing board agenda item to review audit readiness at key points in the year

Done right, audit prep builds trust, reinforces fiscal oversight, and aligns leadership.

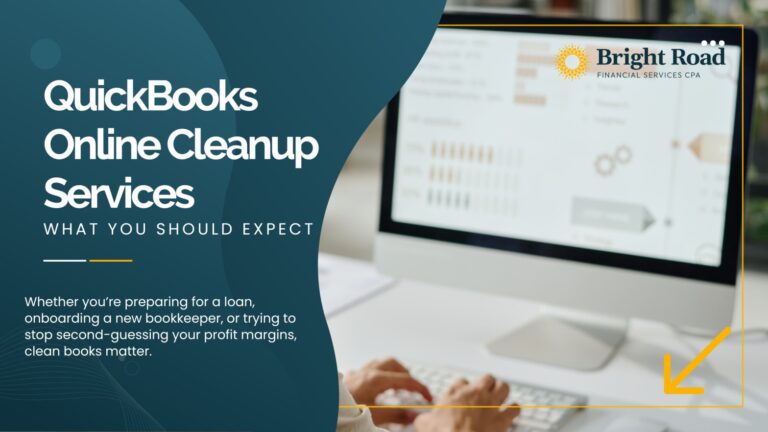

Need a Stress-Free Audit?

Not sure where you stand?

📊 Run your numbers through our free Decode Your Financial Story tool for a quick financial health pulse.

📅 Then book a discovery meeting with Bright Road’s nonprofit cleanup team. We’ll help you:

- Map your audit timeline

- Spot hidden red flags

- Get your board and auditor aligned

We’ve supported organizations across Dayton, Kettering, and the Miami Valley—and we’d love to help yours pass clean, the first time.