Pricing with Confidence: How Fractional CFO Sara Bryson Helps Business Owners Turn Uncertainty into Strategy

If you’ve ever felt uneasy about raising your prices—or wondered whether your business is actually making money—you’re not alone.

For many owners, pricing feels less like a business decision and more like a gamble.

There’s fear of losing clients. Fear of being “too expensive.” Fear of looking unprofessional or greedy.

But according to Sara Bryson, founder of CFOh Yeah and fractional CFO for businesses, those fears often have less to do with numbers and more to do with mindset.

Through clear strategy and judgment-free support, Sara helps entrepreneurs untangle that mix of fear and confusion—so they can finally understand their numbers, make confident decisions, and price for sustainability instead of survival.

From Sculptures to Spreadsheets: An Unlikely Journey

Sara’s story isn’t what you might expect from a CFO. She didn’t major in finance or accounting. In fact, she started out in the arts.

After graduating with a fine arts degree, she did what many creatives do when faced with the practical question of “what now?”—she got a job to pay the bills. That job happened to be as a secretary.

One day, she was handed a login and told she’d be managing the books.

What started as confusion quickly turned into curiosity.

She discovered she loved the logic of it—the way everything fit together, the satisfaction of finding balance. What began as a temporary role soon became a new passion.

Years later, a conversation with a CFO reframed everything. Sara recalls telling him how much she enjoyed building budgets and forecasting, only to have him tell her she wasn’t “just a bookkeeper” at all—she was already doing CFO work.

That moment stuck. And eventually, it became the foundation of her business: helping other owners see that they, too, could rise above the day-to-day grind and think like CEOs.

Why Pricing Feels So Hard

If there’s one thing Sara’s learned from working with hundreds of entrepreneurs, it’s that almost everyone struggles with pricing.

Owners tend to price for survival, not sustainability. They set a rate that feels fair—or that matches what competitors charge—without understanding their true costs or the psychological side of pricing.

Sara sees this play out across industries: people discounting their services out of fear, staying underpriced because they don’t feel “ready” to charge more, or trying to make up lost profit by working twice as hard.

“People will discount themselves to death because they really want the sale,” she says in the interview. “But they don’t think about the cascading effect… if I discount this, I have to sell so much more volume.”

That’s the trap.

When owners underprice, they end up chasing their own tails—burning out, stressing over cash flow, and never getting ahead.

Sara’s goal is to break that cycle. She helps clients separate emotion from math, uncover their true costs, and rebuild their pricing around reality.

The $19.42 Shift That Changed Everything

One client came to Sara with a dream: to leave their full-time job and run their business full time. The only problem? The math didn’t add up.

Sara dug into two years of financials and compared them against industry standards. What she found was simple—but powerful.

If the client increased their average sale by just $19.42, they could quit their job—even if they lost 15% of their customers in the process.

“They were bottom of the barrel priced for what they do for the area,” Sara recalls. “So that amount still wouldn’t have taken him to mid tier. But they didn’t know.”

The lesson? Tiny changes in pricing can have massive impacts when they’re based on accurate data.

That’s the kind of transformation Sara loves most: helping owners see that sustainable growth often starts with small, informed adjustments—not huge leaps.

Turning Numbers into Clarity

For many business owners, numbers are intimidating. Reports feel cryptic, accounting terms sound foreign, and financial meetings can feel like being handed a puzzle without the picture on the box.

Sara’s approach is refreshingly different.

She creates judgment-free spaces for business owners who might feel embarrassed about their books.

“If I take my car to the shop and they’re like, ‘Oh, hey, you’ve got this busted valve,’ what I go, ‘Oh, I should have known.’ No, I’m not a mechanic… And it’s the same for business owners… you’re not accountants. You’re not bookkeepers. You aren’t tax preparers. This isn’t your zone.”

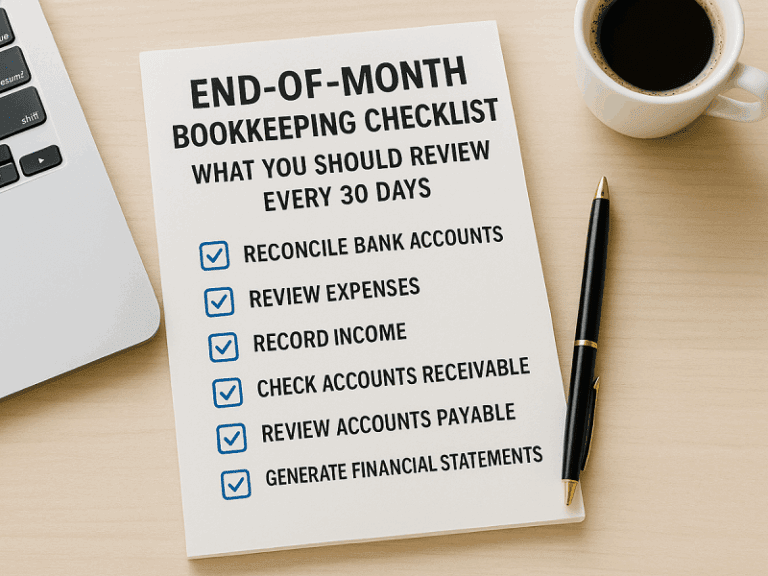

Her checklists and processes take the mystery out of financial management. Whether it’s setting revenue goals, reviewing profit margins, or mapping out pricing strategies, Sara makes the process approachable and even—believe it or not—fun.

Clean Books: The Hidden Advantage

One of the most memorable moments in our conversation was when Sara compared messy books to trying to diagnose a medical problem with only one test.

“Let’s say your doctor did blood work for you because you’ve got something going on… but they only test your cholesterol.,” she says, “Can we build stuff around that? Absolutely… But wouldn’t it be better if we had a full panel? And if we knew we could rely on this full panel to inform the choices moving forward?”

Clean books serve the same purpose for your business. To Sara, bookkeeping isn’t just a compliance task—it’s the foundation of every smart financial decision.

Without clean data, pricing strategies, projections, and forecasts are just guesswork. With it, everything else starts to click.

That’s where our work at Bright Road Financial Services and Sara’s philosophy overlap. Clean, organized books don’t just make tax season easier—they create clarity, confidence, and real decision-making power.

Confidence, Perception, and Value

Pricing, Sara points out, doesn’t just determine revenue—it shapes perception.

She laughs as she compares pricing to brand psychology: “Do you question the value of something you buy at the dollar store? Maybe, right? …What if you buy something from Gucci?” That’s what pricing does—it helps to set the expectation.

It’s not about overcharging; it’s about charging fairly and confidently.

When owners know their worth—and have the data to back it up—they stop negotiating with themselves. That confidence is contagious. Clients sense it. Teams feel it. And the business becomes stronger because of it.

When to Bring in a CFO (Hint: It’s Sooner Than You Think)

Many entrepreneurs assume a CFO is something you hire only once your business is big enough, stable enough, or “ready.” Sara disagrees.

She believes financial strategy should start earlier—when the questions first appear.

“If you’re wondering about your money, if things feel off and you’re just not quite sure what it is,” she says, “reach out, start asking other people, see if you can meet CFO and just have a conversation with them to see what they do.”

That openness reflects how Sara runs her business: honestly, transparently, and with genuine care for the people she works with.

Her “right fit calls” aren’t sales pitches—they’re conversations. Her goal is to point owners toward whatever resource will actually help them, whether that’s a CFO, a bookkeeper, or a different kind of support altogether.

Final Thoughts: Pricing as a Path to Freedom

For Sara, pricing isn’t just about profit margins—it’s about freedom.

When business owners finally understand their numbers, they stop guessing. They stop apologizing for their prices. They stop chasing volume at the expense of sanity.

They start making intentional decisions that align with their goals.

That mindset is exactly what we believe in at Bright Road. Numbers shouldn’t be intimidating—they should empower you.

Whether through better bookkeeping, clearer reports, or guidance from professionals like Sara, the path to confidence always starts with clarity.

Want to connect with Sara?

You can find her at cfohyeah.com.

She also offers free “right fit” calls and shares fantastic insights regularly on LinkedIn.

Don’t Miss the Next Story

If Sara’s story inspired you, there’s more where that came from.

Join the Bright Road newsletter to stay connected for monthly interviews, real-world insights, and practical advice you can actually use.

Each week, we share one short email designed to help you stay organized, make smarter financial decisions, and keep your business moving forward.